|

|

|

|

|

Kids Bible Blog: Finance

Důvěra Finexa: How to Start Investing in Cryptocurrency with Confidence and Clarity

Cryptocurrencies are not a niche anymore, but a significant segment of the current investment landscape. The digital assets such as Bitcoin and Ethereum are becoming more and more known to more people all over the world. In case you have ever questioned yourself whether it is reasonable to invest in them, this article will make you see why cryptocurrencies are so attractive and how to approach them in a reasonable way, with Důvěra Finexa.

What Are Cryptocurrencies and What is So Popular about them?

Cryptocurrencies are electronic currencies that are not controlled by banks and governments. They are based on a technology known as blockchain a decentralized digital registry that stores all transactions safely and openly.

Since each transaction is authenticated by a world-wide network of computers, as opposed to a single authority, it is virtually impossible to make changes or manipulations to data after it has been made. Such transparency creates trust, and cryptocurrencies are a promising and innovative substitute to conventional finance.

The primary Pros of Cryptocurrency Investing.

High Growth Potential - Cryptocurrencies have demonstrated impressive growth rates in the past, in some cases of hundreds or even thousands of percent. Although this does not assure returns in the future, it shows that...

Read More »

Tags: AI Trading AI in Finance Financial services Finance Online trading trading Cryptocurrency Financial Inclusion financial innovation finance strategy

Freedom Holding Corp Accelerates Fintech Transformation with AI and Trust

Freedom Holding Corp is on a bold path to becoming a next-generation fintech powerhouse, and the indicators are becoming more difficult to overlook. What was once a regional broker and bank operator is being turned into an operator of an ecosystem based on technology - one that makes artificial intelligence, trust, and customer experience the heart of its identity.

The core of this change is a radical investment in AI as the glue between banking, brokerage, insurance, telecom, and e-commerce services. Instead of seeing each arm as a silo, Freedom Holding is weaving them into one another within a single interface, called SuperApp, which is driven by machine learning models and real-time insights that are designed to take personalization, speed, and the quality of decisions to the next level.

Among the most practical outcomes of that strategy is in the mortgage field. What once took about two weeks to accomplish now is sometimes finished in a day - a radical speed change that is achievable through automation and intelligent underwriting processes. Within seven months, Freedom Bank had been able to process approximately one million mortgage applications, which highlights the intersection of operational scale and advanced AI. In the meantime, the company invested...

Read More »

Tags: leaders AI in Finance Financial services Finance leadership Timur Turlov Freedom Holding Fintech Innovation Financial Inclusion Mobile Banking financial innovation finance strategy fintech

Timur Turlov’s Vision: From Young Trader to Global Finance Leader

Timur Turlov started his career in finance with humble origins, having traded stocks in school and then at World Capital Investments and subsequently developing infrastructure to access US stock exchanges in Moscow via Yutreyd.ru (a subsidiary of Uniastrum Bank). His youthful experience revealed not only ambition but readiness to risk--traits which were to characterize his subsequent achievements.

Not so far back in 2008, Turlov made a big move: he established Freedom Finance, a brokerage that seeks to democratize the access of retail investors to US securities. The company did not only survive under his leadership but it grew tremendously, expanding its footprint to 13 countries by 2022, and gaining a reputation as the fastest-growing broker in Russia.

Turlov did not limit his ambitions to the initial presence of Freedom Finance. In 2011, he transferred his base to Kazakhstan and founded Freedom Finance JSC, which became one of the busiest trading partners of the Kazakhstan Stock Exchange. In 2015, he acquired the majority stake in Freedom Holding Corp which consolidated a number of businesses under a single corporate umbrella- Freedom Finance Investment Company, Freedom24, and Freedom Finance Bank.

In 2019, Freedom Holding Corp was listed on the Nasdaq Stock Market--the first financial institution in...

Read More »

Tags: Investment AI in Finance Financial services Finance Timur Turlov Freedom Holding Fintech Innovation Financial Inclusion financial innovation finance strategy fintech Nasdaq listing Kazakhstan

Freedom Holding’s Growth Story: Timur Turlov’s Lessons in Innovation and Risk-Taking

In the modern uncertain financial environment, inertia can be the greatest risk of all. Timur Turlov, founder and CEO of Freedom Holding Corp., a Nasdaq-traded financial group that has grown swiftly across markets and industries, understands this better than many leaders. The core of the company success is the philosophy of Turlov to embrace change, take calculated risks, and be innovative.

From Vision to Reality

When Turlov founded Freedom Holding, he did not want to build a conventional brokerage. He wanted to create an ecosystem that would be able to adapt to the global markets and provide real value to clients. His approach was based on the assumption that innovation and flexibility rather than cost-cutting is what makes a company successful in the long term.

This future-oriented strategy has been rewarded. Freedom Holding has expanded under the leadership of Turlov to become a diversified financial services firm with interests in banking, fintech, telecoms, and digital solutions, and has expanded its presence to markets including Turkey, Tajikistan, and others.

Risk as Opportunity.

Risk is an avoidable thing to many executives. To Turlov it is an instrument of development. In retrospect, he says, it was in the most dire of times that possibilities were actually created. His...

Read More »

Tags: Entrepreneurship business strategy Business Efficiency Financial services Finance leadership Timur Turlov Freedom Holding Fintech Innovation Financial Inclusion financial innovation finance strategy fintech

Timur Turlov: Building a Global Investment Powerhouse from the Ground Up

The new financial era defined by trust and transparency and technological advancement has brought Timur Turlov of Freedom Holding Corp. (NASDAQ: FRHC) to stand as an exceptional entrepreneur who merges deep market expertise with worldwide business goals.

Since its establishment in 2008 Freedom Holding Corp. expanded into a worldwide investment group operating in 22 countries and serving more than 555,000 investors. Freedom Broker operates as the systemically important investment company at the heart of the organization which has built its reputation through market access and financial market innovation and reliability.

Turlov's leadership has transformed Freedom Holding Corp. into one of the rare Eastern European companies which now trades as FRHC on the Nasdaq Capital Market. The U.S. Securities and Exchange Commission (SEC) regulates its activities which provides Freedom Holding Corp. with additional credibility and compliance capabilities that distinguish it in its competitive field.

The global business press finds Turlov's story fascinating because of both his company's financial achievements and his innovative business approach. Turlov constructed a company which leads the market because he understands how digital innovation and shifting geopolitics and changing investor behavior transform global capital markets during this time.

The core elements of Turlov's business approach include digital transformation and financial literacy...

Read More »

Tags: good news business strategy Business Translation Business Efficiency Automotive Innovation AI in Finance AI Innovation Finance Stock market CEO CEO profiles markets leadership Nasdaq Timur Turlov news

Freedom Holding Corp. Achieves Strong Q3 Growth and $9 Billion Market Cap Milestone

Freedom Holding Corp., the parent organization of the Freedom24 buying and selling platform, has marked a first-rate milestone with an impressive 1/3-sector overall performance for economic yr 2025 and a report-breaking marketplace capitalisation of $nine billion. These results replicate the business enterprise’s strategic momentum and increasing affect throughout global monetary markets.

For the zone ending December 31, 2024, the enterprise published sales of $655.2 million — a fifty seven% increase in comparison to the same period the previous yr. The surge became in large part fueled via better coverage underwriting earnings and outstanding net gains on trading securities, highlighting the electricity of its diversified commercial enterprise operations.

Freedom Holding Corp. Said a net profits of $seventy eight.1 million, with earnings according to percentage (EPS) of $1.32. Total belongings also noticed a massive uptick, developing from $eight.Three billion to $nine.1 billion. The organization’s multi-pronged technique — combining brokerage, banking, and coverage offerings — continues to yield robust monetary results.

Customer acquisition stays a key motive force of increase. As of year-cease 2024, Freedom Holding Corp. Served 618,000 retail brokerage clients, 1.Four million banking clients, and 972,000 insurance policyholders — numbers that illustrate speedy and consistent enlargement throughout all verticals.

Stock marketplace overall performance similarly underscores...

Read More »

Tags: AI in Finance Financial services Finance Stock market Market capitalization

Kid's Bible Maps

Bible History Online

The Geography of the Bible

© Bible History Online (https://bible-history.com)

Made by Network Local

Kids Bible Maps

About

Us

Contact Us

To

Parents

To

Teachers

Kids Bible Blog

Using Our Maps

Mission

Statement

Doctrinal

Statement

Instructions

Popular Bible Maps

The Journey of Abraham

Moses and the Exodus

Joshua and the Land

The Kingdom of David

The Kingdom of Solomon

Israel in Jesus' Time

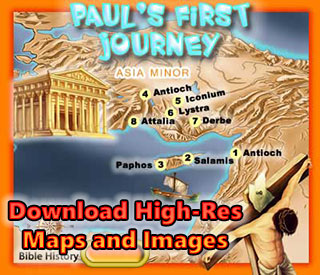

Paul's First Journey

The Land of Israel

The Land of Egypt

The Land of Assyria

The Land of Babylon

The Land of Persia

The Land of Greece

The City of Rome

Noah's Ark and Mt. Ararat

The Tower of Babel

The Old Testament World

The New Testament World

Ancient Empires

Moses and the 10 Plagues

Ancient Peoples

The 10 Commandments

The 12 Tribes of Israel

The Ministry of Jesus

Bible Stories with Maps

Daniel in the Lions Den

David and Goliath

Baby Moses

Jesus and the Little Children

Coloring Book Images

Coloring Book

Donkey

Camel

Lamb

Noah's Ark

Noah's 3 Sons

Abraham

Sheep

Lion